Send Us Email

contact@aifinancialgenius.tech

Project: AI Portfolio Optimization

Welcome to our Portfolio Optimization Sample Report. This presentation showcases the capabilities of our “Financial Analyst PRO” agent in refining a model portfolio derived from a publicly available financial source. Tailored for a Spanish-speaking client, this report provides specific insights in their preferred language.

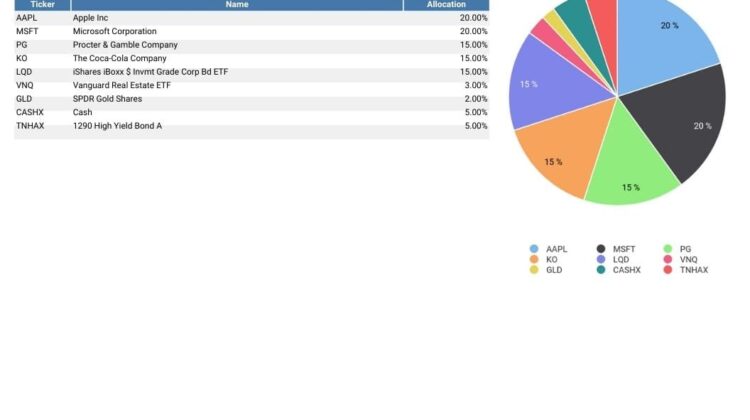

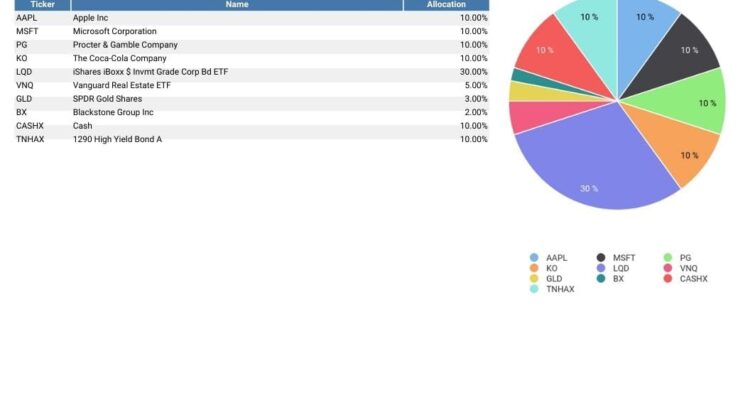

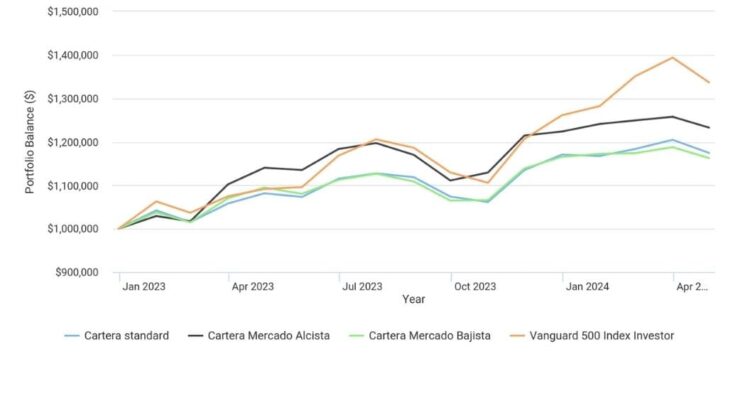

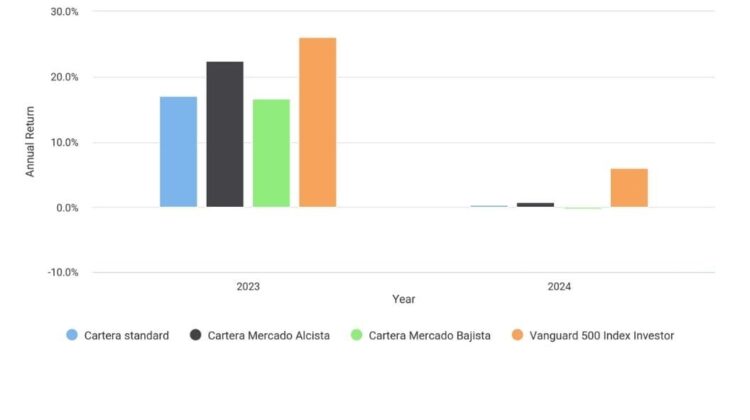

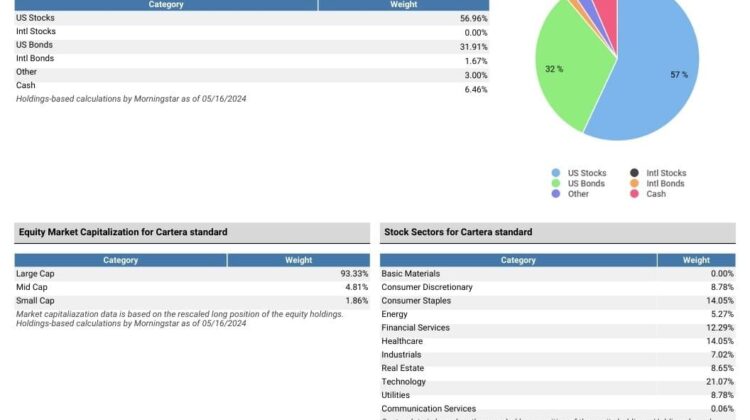

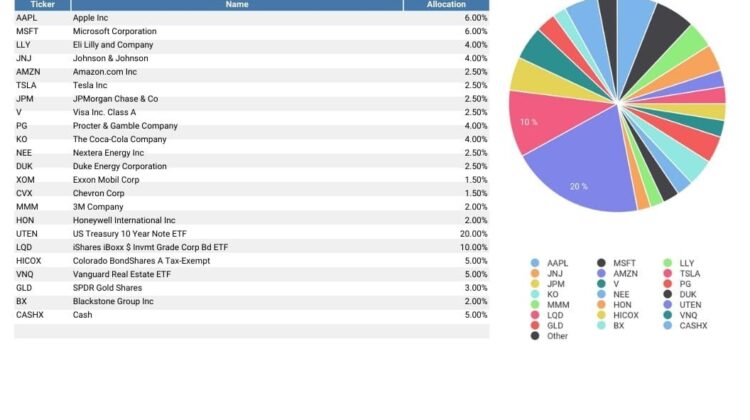

Our advanced AI-driven methodologies were applied to enhance the original portfolio. The optimization process includes dynamic adjustments under various market conditions, demonstrating the robustness and versatility of our strategies. We benchmarked our optimized portfolio against the “Vanguard 500 Index” using the “Portfolio Visualizer” tool to ensure an impartial assessment.

This report highlights our approach’s effectiveness in optimizing real-world portfolios and presents the potential benefits for professional investors.

Project Overview:

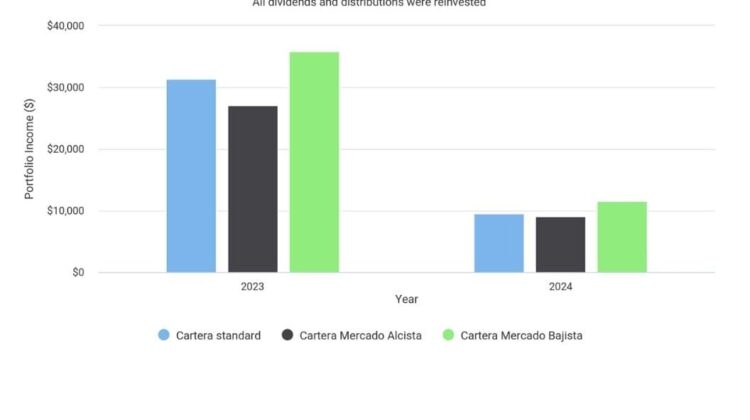

In a bullish market context, such as the recent trend where the Vanguard 500 Index has reached historic highs, our portfolio optimization strategies serve as a complementary approach. While our optimized portfolio did not surpass the benchmark index during this period, it offers enhanced risk management and stability, essential for investors seeking a balanced strategy. These features are crucial for capital preservation and volatility reduction, particularly in fluctuating markets. Our focus is on long-term consistency and capital protection, balancing risk and return effectively.

Our portfolio optimization extends beyond basic asset allocation by incorporating deep analysis and advanced predictive models. This approach dynamically adjusts asset class exposure in response to changing market conditions. Our algorithms consider implied volatility and asset correlations to maximize portfolio resilience, providing strategies that not only target growth opportunities but also mitigate inherent risks, ensuring more stable performance across various market cycles.

Conclusion:

Our portfolio optimization strategies are designed for professional investors aiming to maximize risk-adjusted returns. Through comprehensive analysis and advanced risk management techniques, we offer solutions that integrate seamlessly into existing investment strategies, enhancing stability and performance.